innovation

Lessons Learned from Selling Kubernetes

Cloud-native, containerization, microservices, and Kubernetes have become very popular over the past few years. They are as complex as they are powerful, and for a large, complex organization, these technologies can be a game changer. Kubernetes itself is a partial solution – the foundation for something extraordinary. It can take 20-25 additional products to handle all aspects of the computing environment (e.g., ingres, services mesh, storage, networking, security, observability, continuous delivery, policy management, and more).

Consider the case of a major Financial Services company, one of my clients. They operated with 200 Development teams, each comprising 5-10 members, who were frequently tasked with deploying new applications and application changes. Prior to embracing Kubernetes, their approach involved the deployment of massive monolithic applications with changes occurring only 2-3 times per year. However, with the introduction of Kubernetes, they were able to transition to a daily deployment model, maintaining control and swiftly rolling back changes if necessary. This shift in their operations not only allowed them to innovate at a faster pace but also enabled them to respond to opportunities and address needs more promptly.

Most platforms use Ansible and Terraform for playbooks, configuration management, and more. The configurations could become very long and complex over time and were error-prone. And for more complicated configurations, such as multi-cloud and hybrid configurations, the complexity multiplied. “Configuration Drift,” or runtime configurations that were different than expected for a variety of reasons led to problems like increased costs due to resource misconfiguration, potential security issues based on incorrectly applied or missing policies, and issues with identity management.

The surprising thing was that when prospects did identify those problems, they would look to new platforms that used the same tools to solve their problems. Sometimes, things would temporarily improve (after much time and expense for a migration) but then fall back into disarray since the underlying process issues still needed to be addressed.

Our platform used a new technology called Cluster API (or CAPI). It provided a central (declarative) configuration repository that made it quick and easy to create new clusters. More importantly, it would perform regular configuration checks and reset incorrect or restore missing policies as part of its automatic reconciliation. It was an immutable and self-healing Kubernetes infrastructure. It simplified the overall management of clusters and standardized the implementation of any infrastructure.

All great stuff – who would not want that? This technology was new but proven, but it was different, and that scared some people. These were a couple of recurring themes:

- Platform and DevOps teams had a backlog of work due to existing problems, so there was more fear about falling further behind than believing in a better alternative.

- Teams focused on their existing investment in a platform or on the sunk costs spent over a long period attempting to solve their problems. The ROI on a new platform was often only 3-4 months, but that was challenging to believe, given their experiences on an inferior platform.

- Teams would look at outsourcing the problem to a managed service provider. They could not explain how the problems would be specifically resolved but did not seem concerned about that.

- There was a lack of consistency on the versions of Kubernetes used, the add-ons and their versions, and one-off changes that were never intended to become permanent. Reconciling those issues or migrating to new clean clusters both involved time and effort, which became an excuse to maintain the status quo.

- Unplanned outages were common and usually expensive, but using the cost of those outages as justification for something new tended to be a last resort as people did not like calling out problems that pointed back to themselves.

It was interesting, but focusing on the outcomes and working with the Executives who were most affected by those outcomes tended to be the best path forward. Those companies and teams were rewarded with a platform that simplified fleet management, improved observability, and helped avoid the problems that had plagued them in the past.

Working with satisfied customers who appreciated your efforts and became loyal partners made selling this platform that much more rewarding.

Six Ways AI Can Become a Sales Management Enhancer

As a VP of Sales, I would spend the first 60-90 minutes of every day reviewing a dozen different news sources, looking for information about new technology, competitor announcements, proposed legislation, and M&A news. I looked for anything relevant in critical industries, news about our customers or their top customers, and staffing changes within their companies.

My goal was to identify anything that could negatively impact deals in play, threaten the customer base, disrupt the run rate business, as well as seize opportunities to break into a new company or displace a competitor. You feed your findings and speculations back to your team, along with suggestions, talking points, or specific directions to help them maintain or increase their success for the current quarter plus the next few quarters.

You look for trends and leading indicators that could help your team and your organization achieve greater success. Winning feels good, and the rewards make you want to achieve even more.

Artificial Intelligence (AI) will be able to do all this and more. It will be more consistent, analyze information without bias, and do so on a more timely basis.

1. Automated Intelligence Gathering

Focus your efforts where they add the most value. AI can automate the collection and analysis of data from multiple sources, including news feeds, legal updates, social media, and competitor websites. This automation can save considerable time and minimize the chances of missing relevant information. Natural Language Processing (NLP) can identify, categorize, and correlate relevant information, providing actionable insights without the need for manual review.

2. Enhanced Lead and Opportunity Identification

In addition to the correlations above, Machine Learning (ML) models can analyze trends and patterns in data to identify potential leads or opportunities for expansion. By understanding market movements, customer behaviors, historical behavior, and presumptive competitor strategies, AI can suggest new targets for sales efforts and highlight areas where teams could gain a competitive edge.

3. Improved Internal Communication and Collaboration

Sales is not just about selling but also about collaborating internally to create the best possible products and services to sell and identify the best approaches to generate awareness and interest in your offerings.

AI systems can serve as a central hub for information that benefits various departments within a company. By integrating with CRM, marketing, support, and other internal systems, AI can distribute tailored information to different teams, ensuring that everyone has the best insights to perform their roles effectively and promoting a more cohesive and coordinated approach to achieving long-term business objectives.

4. Forecasting and Predictive Analytics

With the ability to process vast amounts of data, AI should significantly improve forecasting accuracy. Predictive analytics can estimate future sales trends, customer demands, and market dynamics, providing businesses with more opportunities to make better-informed decisions—better resource allocation, optimized sales strategies, and, ultimately, higher revenue will be the result.

5. Increased Efficiency and ROI

By automating routine tasks and providing deep insights, AI can free up sales and management teams to focus on strategic activities. The efficiency gains from AI can result in significant cost savings and a higher return on investment (ROI) as teams do more with less, capitalize on opportunities faster and more effectively, and ultimately make more money for themselves and their company.

6. Continuous Learning and Improvement

Machine learning models will improve over time as they process more data, meaning the insights and recommendations provided by AI will become increasingly accurate and valuable, helping businesses continuously refine their strategies and operations for better outcomes.

Future Perspectives

While it’s true that AI may not yet be ready to take over complex roles like enterprise sales, its potential to enhance these roles is undeniable. As AI technology continues to evolve, its ability to provide highly accurate forecasts, improve win rates, shorten sales cycles, and enhance competitiveness will only grow. The future of AI in sales and business management is not just about automation but about augmenting human capabilities to create more effective, efficient, and thriving organizations that are better able to compete in an increasingly competitive global landscape.

So, what do you think? Will this work? Will it be good enough if everyone is doing it? Leave a comment and let us know.

“Acting Like a Startup”

Over the years, I have heard comments like, “We operate like a startup,” “We act like a startup,” and “We are an overnight success that was 10 years in the making.” These statements are often euphemisms for “We are small and not growing as quickly as we would like.”

There are numerous estimates of startups in their first few years. One of the best descriptions I have found is from Failory, but Investopedia and LendingTree have similar but differing take on the statistics and root causes. All three articles linked to are worth reading. The net result is that the outcome of failure is much greater than success, especially over time. So, “acting like a startup” is not necessarily good, even when true. You want to act like a successful startup!

Understanding the data and various causes for success and failure are great inputs to business plans. I have been a principal with successful startups, both early employees and founders. Understanding the data and various causes for success and failure are significant inputs to business plans focused on long-term success. As a Founder, there are a few points that I believe to be key to success:

- You have specific expertise that is in demand and would be valuable to an identifiable number of prospective customers. How would those customers use those skills, and how would they quantify the value? That understanding provides focus on what to sell and to whom.

- A detailed understanding of the market and key players is needed to hone in on a niche to succeed.

- Understand your strengths and weaknesses, then hire the most intelligent and ambitious people who complement your weaknesses and strengths.

- Understand how to reach those potential customers and the messaging you believe will compel them. Then, find a way to test and refine those assumptions as necessary. Marketing and Lead Generation are very important.

- Have a plan for delivering on whatever you sell before you get your first sale. A startup needs to develop its track record of success, beginning with its first sale.

- Cash flow is king. It is far too easy to run out of money while looking at an excellent balance sheet because of receivables. Understand what matters and why.

- Founders need to understand the administrative side of a business – especially the financial, legal (especially contract law), insurance, and taxes. Find experts to validate your approach and fill in knowledge gaps.

- Consistency leads to repeatable success. You standardize, optimize, and automate everything possible. Wasted time and effort become wasted opportunities.

- Finally, there needs to be sufficient cash on hand to fund the time it takes to find and close your first deals, deliver and invoice the work, and then receive your first payments. That could easily be a 3-6 month period.

Those are the foundational items that are reasonably tangible. What is not as concrete but equally as important are:

- Having or developing the ability to spot trends and identify gaps that could become opportunities for your business.

- An agile mindset allows you to pivot your offerings or approach to refine your business model and hone in on that successful niche for your business.

- Foster a sense of innovation within your business. Always look for opportunities to deliver a better product or service, improve the efficiency and effectiveness of your business, and create intellectual property (IP) that adds long-term value.

- Focus on being the best and building a brand that helps differentiate you from your competition.

- Become a Leader, Not a Manager. Create your vision of success, set expectations for each person and team, and help eliminate roadblocks to their success. Trust your team to help you grow and replace members quickly if it becomes clear they are not a good fit.

Steve Jobs once said, “It doesn’t make sense to hire smart people and then tell them what to do; we hire smart people so they can tell us what to do.”

Winning is hard, so focus on the journey. Making your customers’ lives easier and allowing your employees to be creative while doing something they are proud of will lead you to your destination. But when things start going well, don’t sit back and convince yourself you are successful. Instead, continue to focus on ways to improve and grow.

Success means different things to different people, but longevity, growth, profitability, and some form of contributing to the greater good should be dimensions of success for any vision.

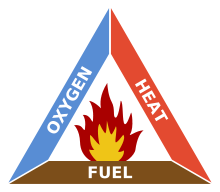

Innovations “Iron Triangle”

The concept of an Iron Triangle is that along each side of the triangle is one item constrained by the items from the other two sides. In Project Management, this is often referred to as a triple constraint. This identifies the fundamental relationships (such as Time, Cost, and Scope in Project Management) without addressing related aspects such as Risk and Quality. It provides a simple understanding of both requirements and tradeoffs.

Yesterday I spoke with Dave Mosby, an impressive person with an equally impressive background. He related Innovation to Fire, noting that in order to create fire, you need fuel, oxygen, and heat. He added that they must be in the right combination to achieve the desired flame. What a brilliant analogy.

Dave stated that for Corporate Innovation to succeed, you need the proper balance of Innovation, Capital, and Entrepreneurship. I found this enlightening because his description substituted “entrepreneurship” for “culture” in my mental model. While the difference is subtle, I found it to be important.

As noted above, simplified frameworks do not provide a complete understanding. But they help understand and plan around the foundational items required for success. Mapping this to past experiences, I gained a better understanding of things that did not move forward as desired and what I could have done differently to be more effective.

One idea was to create a fault-tolerant database using Red Hat’s JBoss middleware. We had a Services partner willing to create a working prototype, tune it for performance, document the system requirements and configuration, and package it for easy deployment. They wanted $10K to cover their costs.

I did not hold a budget at the time, so I created a purchase request supported by a logical justification. It modeled potential revenue increases for database subscriptions based on the need for a failover installation and growth from potential expanded use cases. This was a slam dunk!

In my mind, this was simple as it was “only $10K,” and I had funded many similar efforts when I had my own company. But that’s the rub. I viewed these efforts as investments in understanding, lessons learned, and growth. Not every investment had a direct payoff, but nearly each had an indirect payoff for my company. It was an entrepreneurial mindset that accepted risk as something required for rewards and success. I now see, many years later, how reframing my proposal as a way to foster innovation and entrepreneurship could have been far more effective.

It is never too late to gain new insights and lessons learned. A slightly different perspective on an important topic provided the understanding that should help position projects for future success. And this flowed from a discussion with an interesting person who has “been there, done that” many times.

Interesting Article about ADHD and Creativity

This “pocket” story is from Scientific American, originally published on March 5, 2019. The Creativity of ADHD.

Over the years, I have found that some of the most interesting, creative, and effective CEOs have ADHD-like tendencies. Strangely, they may not even be aware that they have it. Hyperfocus can be incredibly effective when attached to a driven person.

Below are links to a couple of posts that make these concepts and their benefits tangible:

These are examples of why it is best to look beyond labels, lay your preconceived notions aside, and explore each individual’s potential to contribute. The best managers and leaders tend to have this ability.

And if you want to take that a step further, let it guide you in finding the best approach to teaching, coaching, and motivating your team members. It may take a little extra effort, but the results are amazing.