growth

Knowing When to Stop

What’s the hardest decision you’ve ever had to make? Why?

Jetpack Question of the Day

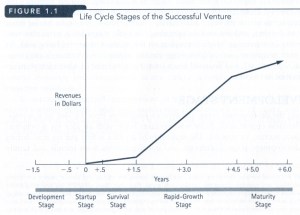

In 2000 we started developing a Franchising System for Business Consulting. We had invested over $100K and were making progress, but we were about 6 months behind schedule when 9/11 occurred.

Everything came to a standstill for a few months. In early 2002 we reevaluated the situation. We were about $50K and less than 6 months from completion. But the total addressable market had shrunk considerably, and there was no telling if or when it might recover.

We had to decide whether to invest more and potentially lose more or kill the project and cut our losses. The decision was difficult. We ultimately decided to cut our losses and walk away from our investment in time and money. It was probably the right decision, but it was still very difficult.

For anyone interested, this post goes into more detail on this topic.

Continuous Improvement, Growth Mindset, and an “Attitude of Better”

This was originally posted on LinkedIn.com/in/chipn

When I had my own company, we focused on providing the absolute best services in a few niche areas. Our goal was to succeed in the spaces that were important yet underserved. We identified those areas, validated the need, evaluated the competition and our competitive positioning, determined the market potential, and then made an informed decision based on that data.

But, this was not a plan for winning. It was a roadmap to places we could win, but nothing more. What would our strategy be? What specific problems would we solve? How would we create awareness around the potential impact of those problems? And how would we position ourselves as the best candidates to address those business needs? In short, what was our real purpose or raison d’etre?

Recognizing that void led to a couple of powerful revelations –

1. It is great to have a goal of being the best at something, but don’t use that as an excuse to procrastinate. Learning and improving is an iterative process, so that goal itself was not good enough.

2. Adopting an “Attitude of Better” became a game-changer. We set our focus on continuous improvement and winning. We became customer-obsessed, driven to provide better service and better results for every customer. We gauged our success by customer satisfaction, repeat engagements, and referrals.

3. But it wasn’t until we adopted an intentional Growth Mindset that our business evolved and improved.

· We leveraged every win to help us find and create the next one.

· Our team constantly pushed each other to raise the bar of knowledge, expertise, and performance.

· Just as important was what occurred next. They became a safety net for each other. Failure for one meant failure for all, and nobody wanted that. They became a high-performance team.

· We created standard processes and procedures to ensure consistency and maintain the highest levels of quality. This applied to everything we did – from working on a task to writing trip reports, status reports, and proposals. It also reduced our risks when we chose an outsourcing partner to help us take on more concurrent projects.

· Whenever possible, we automated processes to maintain consistency while increasing efficiency, repeatability, scalability, and profitability.

· We measured and tracked everything, analyzed that data, captured lessons learned, and continuously worked on improving (and documenting) every aspect of the business.

· A byproduct of this approach was that we could offer leaner pricing based on accurate estimates with very small error margins. Our pricing was competitive, we could fix the price for much of what we did, and our profit margins were very good. This allowed us to invest in further growth.

Our “attitude of better” also came across as confidence when selling to and working with new customers. Not only could we tell them stories of our success that included tangible metrics, but most of our customers became references willing to talk about the value we added. Their stories included discussions about how much better things became due to our work.

Better became the foundation of what we did and the basis of those customer success stories.

Could a New Channel Model Lead to Sales Amplification?

Over the years, I have helped successful companies and start-ups improve and strengthen their Channel and Strategic Alliances programs. Those companies do a great job closing deals but usually have concerns about not generating or receiving enough new business leads. Or, they develop strong relationships with one or two vendors, only to find later that a key vendor has been sending deals to a competitor.

Most traditional channel models support Distributors, Resellers, OEMs, and ISVs. The business mainly flows upwards to the main vendor. If that vendor has popular and widely used products, then business can be good because of sufficient demand. But when that is not the case, your sales pipeline usually suffers.

Doing something the same way as everyone else may not be a bad approach when there is enough business for everyone, and your growth goals and aspirations are aligned with your competition.

Sales Channel business is usually not the main source of revenue for most companies, but it does have the potential to become the largest and most scalable revenue source for nearly any business. Just think about the money left on the table by not adopting a growth mindset and executing a new and better strategy.

In the summer of 2016, I attended the “Sage Summit” in Chicago. It was impressive to see the Sage Group’s efforts to build, strengthen, and protect their Customers and Channel Partners community. They tried to foster higher levels of collaboration between the various types of partners – implementation services, consulting, staff augmentation services, complementary product vendors, etc. They had created their own highly successful Business Ecosystem, which is an excellent proof point.

When designing a channel partner program, my focus has always been on finding the balance between promoting and protecting the partners’ business and helping ensure that the end customers have the best experience possible (and have some recourse when things do not work out as expected). There are a variety of methods I have used to accomplish those goals, but the missing component has always been the inclusion of a systematic approach to seed relationships between those partners and facilitate an even greater volume of business activity.

Nearly a year ago, I began working with a management consultancy run by Robert Kim Wilson, which has a business vision based on his book, “They Will Be Giants.” I will provide links for this book and other relevant resources at the bottom of the post. Kim asserts that Entrepreneurs with a Purpose-Driven Business Ecosystem (PDBE) are more successful than those without one, providing examples to prove his point. Having experienced Kim’s PDBE, I see how purpose fosters trust and collaboration.

As I did more research, I found that, especially over the past two years, a lot of focus has been placed on Business Ecosystems and Business Ecosystem Organizers (such as Sage in the earlier example). Those findings reinforced the PDBE approach, and external validation is always good.

It is just as important from my perspective that this concept applies to businesses of any size, and it is especially helpful to small to midsize businesses. The fun part for me is exploring a specific business, analyzing what they do today, and quantifying the benefits of adopting this new strategy.

So, how does this new type of Business Ecosystem work?

- The Business Ecosystem Organizer expands the overall network, vets new “Business Ecopartners,” and provides a framework or infrastructure for the various Business Ecopartners to get to know one another, exchange ideas, and discuss opportunities.

- This can become an incredibly sustainable revenue source for companies willing to invest in the necessary components to grow and support their Business Ecosystem.

- Business Ecopartners will have access to trusted resources to augment existing business and take on new, bigger projects by leveraging the available expertise.

- Suppose that you have products or services that work with commercial CRM (Customer Relationship Management), ERP (Enterprise Resource Planning), or SCM (Supply Chain Management).

- You have seen a growing demand for functionality that relies on highly specialized technologies like:

- Cryptocurrency support.

- Blockchain for financial transactions and things like traceability in your supply chain or IoT data.

- AI (artificial intelligence) and ML (machine learning) to detect patterns and anomalies – such as fraud detection, Deep Learning/Neural Networks for image recognition or other complex pattern recognition.

- Graph databases to better understand a business and infer new ways to improve it.

- Knowledge Graph/Semantic databases to assist with Transfer Learning and deeper understanding.

- Building these practices in-house would not be practical or cost-effective for most businesses, so partnering becomes very attractive to your company.

- This type of business can also be very attractive to a Business Ecopartner because someone else handles sales, billings, account management, etc.

- Other Business Ecopartners could leverage your products or services for their projects and engagements, thus becoming another source of revenue.

- By leveraging this network, your business can compete on imagination and innovation – which could become a huge source of differentiation from your competition.

Value realized from this New Business Ecosystem model:

- These new sources of business and talent can become a real competitive advantage for your business.

- This becomes the source for Sales Amplification because your business is, directly and indirectly, expanding its reach and growth potential.

- The weighted (based on capabilities, capacity, responsiveness, and Ecopartner feedback) Business Ecopartner network model could lead to exponential business growth – a winning strategy for any business.

References:

- https://kimwilson5.wixsite.com/theywillbegiants/the-book

- https://www.bcg.com/publications/2019/emerging-art-ecosystem-management.aspx

- https://www.gartner.com/smarterwithgartner/8-dimensions-of-business-ecosystems/

- https://sloanreview.mit.edu/article/the-myths-and-realities-of-business-ecosystems/

- https://www2.deloitte.com/us/en/pages/operations/articles/business-ecosystems.html

- https://www.accenture.com/_acnmedia/pdf-56/accenture-strategy-your-role-in-the-ecosystem.pdf

- https://www.bain.com/insights/shifting-from-assets-to-ecosystems-video/

- https://hbr.org/2019/09/in-the-ecosystem-economy-whats-your-strategy

One Successful Approach to Innovation that worked for an SMB

When I owned a consulting company, we viewed innovation as an imperative. It was the main thing that created differentiation, credibility, and opportunity. We had an innovation budget, solicited ideas from the team, and evaluated those ideas quarterly.

Almost as important to me was that this was fun. It allowed everyone on the team to suggest ideas and participate in the process. That was meaningful and supported the collaborative, high-performance culture that had developed. The team was inspired and empowered to make a difference, and that led to an ever-increasing sense of ownership for each employee.

The team also had a vested interest in having the process work, as quarterly bonuses were paid based on their contributions to the company’s profitability. There was a direct cause-and-effect correlation with tangible benefits for every member of the team.

We developed the following 10 questions to qualify & quantify the potential of new ideas:

- What will this new thing do?

- It is important to be very detailed as this was used to create a common vision of success based on the presented idea.

- What problem(s) does this solve, and how so?

- This seems obvious, but selling this new product will be an uphill challenge if you are not solving a problem (which could be something like “lack of organic expansion”) or addressing a pain point.

- What type of organizations have those problems and why?

- This was fundamental to understanding if a fix was possible from a practical perspective, what the value of that fix might be for the target buyer, and how much market potential existed to scale this new offering.

- What other companies have created solutions or are working on solutions to this problem?

- The lack of competition today does not mean you are the first to attack this problem. Due diligence can help avoid repeating the failure of others, potentially providing lessons learned by others and helping you avoid similar pitfalls.

- Will this expand our existing business, or does it have the potential to open up a new market for us?

- Each answer has upsides and downsides, but breaking into a new market can take more time and be more difficult, time-consuming, and expensive to achieve.

- Is this Strategic, Tactical, or Opportunistic?

- An idea may fall into multiple categories. When the Sarbanes-Oxley (SOX) Act became law, we viewed a new service offering as a tactical means to protect our managed services business and an opportunistic means to acquire new customers and grow the business. While this is not true innovation, IMO, it was an offering that flowed from this defined process.

- What are the Cost, Time, and Skill estimates for developing a Minimally Viable Product (MVP) or Service?

- What are the Financial Projections for the first year?

- Cost to develop and go to market.

- Target selling price, factoring in early adopter discounts.

- Estimated Contribution Margin Ratio (for comparison with other ideas being considered).

- Break-even point.

- Would we be able to get an existing customer to pre-purchase this?

- A company willing to provide a PO that commits to purchasing that MVP within a specific timeframe increased our confidence in the viability of the idea.

- What are the specific Critical Success Factors to be used for evaluation purposes?

- This important lesson learned over time helped minimize emotional attachment to the idea or project and provided objective milestones for critical go / no-go decision-making.

This process was purposeful, agile, lean, and somewhat aggressive. We believed it gave our company a competitive advantage over larger companies that tended to respond slower to new opportunities and smaller competitors that did not want to venture outside their wheelhouse.

With each project, we learned and became more efficient and effective and made better investment decisions that positively impacted our success. We monitored progress on an ongoing basis relative to our defined success criteria and adjusted or sunset an offering if it stopped providing the required value.

The process was not perfect…

For example, we passed on some leading-edge ideas, such as a “Support Robot” in 2003, an interactive program that used a machine-learning algorithm. It was to be trained using historical log files, could quickly and safely be tested in a production environment, refined as needed, and ultimately validated.

This automation could have been used with our existing managed services and Remote DBA customers to further mitigate the risk of unplanned outages. Most importantly, it would have provided leverage to take on new business without jeopardizing quality or adding staff – thereby increasing revenue and profit margin.

At the time, we believed this would be too difficult to sell to prospective customers (“pipe dream” and “snake oil” were some of the adjectives we envisioned), so it appeared to lack a few items required by the process. Live and learn.

In summary, having a defined approach for something as important as business needs innovation to grow and prosper, as best demonstrated by market leaders like Amazon and Google (read the 10-K Annual Reports to gain a better understanding of their competitive growth strategies that are largely based on innovation).

Implementing this type of approach within a larger organization requires additional steps, such as getting the buy-in from a variety of stakeholders and aligning with existing product roadmaps, but it is still the key to scalable growth for most businesses.

The Importance of Proper Pricing

Pricing is one of those things that can make or break a company. Doing it right takes an understanding of your business (cost structure and growth / profitability goals), the market, your competition, and more. Doing it wrong can mean the death of your business (fast or slow), the inability to attract and retain the best talent, as well as creating a situation where you will no longer have the opportunity to reach your full potential.

These problems apply to companies of all sizes – although large organizations are often better positioned to absorb the impact of bad pricing decisions or sustain an unprofitable business unit. Understanding all possible outcomes is an important aspect of pricing related to risk and risk tolerance.

When I started my consulting company in 1999, we planned to win business by pricing our services 10%-15% lower than the competition. It was a bad plan that didn’t work. Unfortunately, this approach is something you see all too often in businesses today.

We only began to grow after increasing our prices (about 10% more than the competition) and focused on justifying that with our expertise and the value provided. We were (correctly) perceived as a premium alternative, and that positioning helped us grow.

Several years ago, I had a management consulting engagement with a small software company. The business owner told me they were “an overnight success 10 years in the making.” His concern was that they might not be able to capitalize on recent successes, so he was looking for an outside opinion.

I analyzed his business, product, customers, and competition. His largest competitor is the industry leader in this space, and products from both companies were evenly matched from a feature perspective. My client’s product even had a few key features that were better for management and compliance in Healthcare and Union environments that his larger and more popular competitor lacked. So, why weren’t they growing faster?

I found that competition was priced 400% higher for the base product. When I asked the owner, he told me their goal was to be priced 75% – 80% less than the competition. He could not explain why he did this other than to state that he believed that his customers would be unwilling to pay any more than that. His lack of confidence in his product became evident to companies interested in his solution.

He often lost head-to-head competition against that competitor, but almost never on features. Areas of concern were generally the size and profitability of the company and the risk created by each for prospects considering his product.

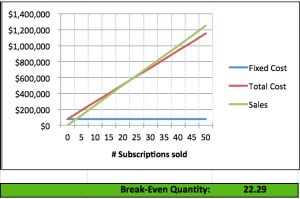

I shared the graph (below) with this person, explaining how proper pricing would increase their profitability and annual revenue and how both of those items would help provide customers and prospects with confidence. Moreover, this would allow the company to grow, eliminate single points of failure in key areas (Engineering and Customer Support), add features, and even spend money on marketing. Success breeds success!

In another example, I worked with the Product Manager of a large software company responsible for producing quarterly product package distributions. This work was outsourced, and each build cost approximately $50K. I asked, “What is the break-even point for each distribution?” That person replied, “There really isn’t a good way to tell.”

By the end of the day, I provided a Cost-Volume-Profit (CVP) analysis spreadsheet that showed the break-even point. Even more important, it showed the contribution margin and demonstrated there was very little operating leverage provided these products (i.e., they weren’t very profitable even if you sold many of them).

My recommendations included increasing prices (which could negatively impact sales), investing in fewer releases per year, or finding a more cost-effective way of releasing those products. Without this analysis their “business as usual” approach would have likely continued for several years.

Companies are in business to make money – pure and simple. Everything you do as a business owner or leader needs to be focused on growth. Growth is the result of a combination of factors, such as the uniqueness of the product or services provided, quality, reputation, efficiency, and repeatability. Many of these are the same factors that also drive profitability. Proper pricing can help predictably drive profitability, and having excess profits to invest can significantly impact growth.

Some customers and prospects will do everything possible to whittle your profit margins down to nothing. They are focused on their own short-term gain and not on the long-term risk created for their suppliers. Those same “frugal” companies expect to profit from their own business, so it is unreasonable to expect anything less from their suppliers.

My feeling is that “Not all business is good business,” so it is better to walk away from bad business in order to focus on the business that helps your company grow and be successful.

One of the best books on pricing I’ve ever found is “The Strategy and Tactics of Pricing: A Guide to Profitable Decision Making” by Thomas T. Nagle and Reed K. Holden. I recommend this extremely comprehensive and practical book to anyone responsible for pricing or with P&L responsibility within an organization. It addresses the many complexities of pricing and is truly an invaluable reference.

In a future post, I will write about the metrics I use to understand efficiency and profitability. Metrics can be your best friend when optimizing pricing and maximizing profitability. This can help you create a systematic approach to business that increases efficiency, consistency, and quality.

At my company we developed a system where we know how long common tasks would take to complete, and had efficiency factors for each consultant. This allowed us to create estimates based on the type of work and the people most likely to work on the task and fix-bid the work. Our bids were competitive, and even when we were the highest-priced bid we often won because we would be the only (or one of the few) companies to guarantee prices and results. Our level of effort estimates were +/- 4%, and that helped us maintain a 40%+ minimum gross margin for every project. This analytical approach helped our business double in revenue without doubling in size.

There are many causes of poor pricing, including a lack of understanding of cost structure; Lack of understanding of the value provided by a product or service; Lack of understanding of the level of effort to create, maintain, deliver, and improve a product or service; and Lack of concern for profitability (e.g., salespeople who are paid on the size of the deal, and not on margins or profitability).

But, with a little understanding and effort, you can make small adjustments to your pricing approach and models that can have a huge impact on your business’s bottom line.