strategy

The Importance of Proper Pricing

Pricing is one of those things that can make or break a company. Doing it right takes an understanding of your business (cost structure and growth / profitability goals), the market, your competition, and more. Doing it wrong can mean the death of your business (fast or slow), the inability to attract and retain the best talent, as well as creating a situation where you will no longer have the opportunity to reach your full potential.

These problems apply to companies of all sizes – although large organizations are often better positioned to absorb the impact of bad pricing decisions or sustain an unprofitable business unit. Understanding all possible outcomes is an important aspect of pricing related to risk and risk tolerance.

When I started my consulting company in 1999, we planned to win business by pricing our services 10%-15% lower than the competition. It was a bad plan that didn’t work. Unfortunately, this approach is something you see all too often in businesses today.

We only began to grow after increasing our prices (about 10% more than the competition) and focused on justifying that with our expertise and the value provided. We were (correctly) perceived as a premium alternative, and that positioning helped us grow.

Several years ago, I had a management consulting engagement with a small software company. The business owner told me they were “an overnight success 10 years in the making.” His concern was that they might not be able to capitalize on recent successes, so he was looking for an outside opinion.

I analyzed his business, product, customers, and competition. His largest competitor is the industry leader in this space, and products from both companies were evenly matched from a feature perspective. My client’s product even had a few key features that were better for management and compliance in Healthcare and Union environments that his larger and more popular competitor lacked. So, why weren’t they growing faster?

I found that competition was priced 400% higher for the base product. When I asked the owner, he told me their goal was to be priced 75% – 80% less than the competition. He could not explain why he did this other than to state that he believed that his customers would be unwilling to pay any more than that. His lack of confidence in his product became evident to companies interested in his solution.

He often lost head-to-head competition against that competitor, but almost never on features. Areas of concern were generally the size and profitability of the company and the risk created by each for prospects considering his product.

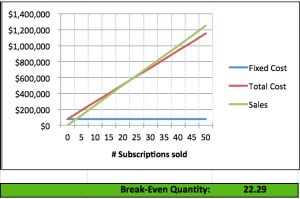

I shared the graph (below) with this person, explaining how proper pricing would increase their profitability and annual revenue and how both of those items would help provide customers and prospects with confidence. Moreover, this would allow the company to grow, eliminate single points of failure in key areas (Engineering and Customer Support), add features, and even spend money on marketing. Success breeds success!

In another example, I worked with the Product Manager of a large software company responsible for producing quarterly product package distributions. This work was outsourced, and each build cost approximately $50K. I asked, “What is the break-even point for each distribution?” That person replied, “There really isn’t a good way to tell.”

By the end of the day, I provided a Cost-Volume-Profit (CVP) analysis spreadsheet that showed the break-even point. Even more important, it showed the contribution margin and demonstrated there was very little operating leverage provided these products (i.e., they weren’t very profitable even if you sold many of them).

My recommendations included increasing prices (which could negatively impact sales), investing in fewer releases per year, or finding a more cost-effective way of releasing those products. Without this analysis their “business as usual” approach would have likely continued for several years.

Companies are in business to make money – pure and simple. Everything you do as a business owner or leader needs to be focused on growth. Growth is the result of a combination of factors, such as the uniqueness of the product or services provided, quality, reputation, efficiency, and repeatability. Many of these are the same factors that also drive profitability. Proper pricing can help predictably drive profitability, and having excess profits to invest can significantly impact growth.

Some customers and prospects will do everything possible to whittle your profit margins down to nothing. They are focused on their own short-term gain and not on the long-term risk created for their suppliers. Those same “frugal” companies expect to profit from their own business, so it is unreasonable to expect anything less from their suppliers.

My feeling is that “Not all business is good business,” so it is better to walk away from bad business in order to focus on the business that helps your company grow and be successful.

One of the best books on pricing I’ve ever found is “The Strategy and Tactics of Pricing: A Guide to Profitable Decision Making” by Thomas T. Nagle and Reed K. Holden. I recommend this extremely comprehensive and practical book to anyone responsible for pricing or with P&L responsibility within an organization. It addresses the many complexities of pricing and is truly an invaluable reference.

In a future post, I will write about the metrics I use to understand efficiency and profitability. Metrics can be your best friend when optimizing pricing and maximizing profitability. This can help you create a systematic approach to business that increases efficiency, consistency, and quality.

At my company we developed a system where we know how long common tasks would take to complete, and had efficiency factors for each consultant. This allowed us to create estimates based on the type of work and the people most likely to work on the task and fix-bid the work. Our bids were competitive, and even when we were the highest-priced bid we often won because we would be the only (or one of the few) companies to guarantee prices and results. Our level of effort estimates were +/- 4%, and that helped us maintain a 40%+ minimum gross margin for every project. This analytical approach helped our business double in revenue without doubling in size.

There are many causes of poor pricing, including a lack of understanding of cost structure; Lack of understanding of the value provided by a product or service; Lack of understanding of the level of effort to create, maintain, deliver, and improve a product or service; and Lack of concern for profitability (e.g., salespeople who are paid on the size of the deal, and not on margins or profitability).

But, with a little understanding and effort, you can make small adjustments to your pricing approach and models that can have a huge impact on your business’s bottom line.

Lessons Learned from Small Business Ownership

I learned many valuable lessons over the course of the 8+ years that I owned my consulting business. Many were positive, a few were negative, but all were educational. These lessons shaped my perceptions about and approaches to business, and have served me well. This post will just be the first of many on the topic.

My lessons learned covered many topics: How to structure the business; Business Goals; Risk; Growth Initiatives and Investment; Employees and Benefits; Developing a High-Performance Culture; Marketing and Selling; Hiring and Firing; Bringing in Experts; Partners and Contractors; The need to let go; Exit Strategies and more.

In my case these lessons learned were compounded by efforts to start a franchise for the consulting system we developed, and then our expansion to the UK with all of the challenges associated with international business.

It’s amazing how more significant those lessons are (or at least feel) when the money is coming out of or going into “your own pocket.” Similar decisions at larger companies are generally easier, and (unfortunately) often made without the same degree of due diligence. Having more “skin in the game” does make a difference when it comes to decision making and risk.

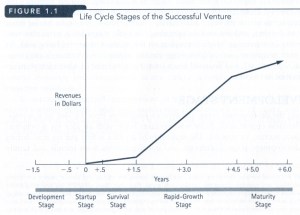

Businesses are usually started because someone is presented with a wonderful opportunity, or because they feel they have a great idea that will sell, or because they feel that they can make more money doing the same work on their own. Let me start by telling you that the last reason is usually the worst reason to start a business. There is a lot of work to running a business, a lot of risk, and many expenses that most people never consider.

I started my business because of a great opportunity. There were differences of opinion about growth at the small business I was working for at the time, and this provided me with the opportunity to move in a direction that I was more interested in (shift away from technical consulting and move towards business / management consulting). Luckily I had a customer (and now good friend) who believed in my potential and the value that I could bring to his business. He provided both the launch pad and safety net (via three month initial contract) that I needed to embark on this endeavor. For me the most important lesson learned is to start a business for the right reasons.

More to come. And, if you have questions in the meantime just leave a comment and I will reply. Below are some of the statistics on Entrepreneurship that can be pretty enlightening:

Bureau of Labor Statistics stats on Entrepreneurship in the US

Things that make you go hmmm

This week I read a story about Astronomers finding a new, free-floating planet (PSO J318.5-22). What I loved about this story is that the planet defies the definition of a planet, as it does not orbit a star. It’s something that shouldn’t exist, or at least something that exists outside the current astronomical framework.

It’s funny how you grow up being taught what is right and how things should work. While knowledge and understanding are good, they can also be limiting. When you just know something should not work, it becomes easy to accept that and move on. It can be a real innovation killer.

Occasionally, something new, different, and sometimes even inconsequential comes around and makes a big difference. Think about Apple’s iTunes. It was created merely as a means to sell iPods. Critics said it would never work. But, it created a paradigm shift in how people consumed and purchased music and video content. Now it is one of the fastest growing businesses within Apple.

Or, think about Twitter. An idea for a microblogging service to send text messages to a group of friends. Now news is reported via tweets, and social media of all types use hashtags to create communities and generate buzz. Something that should have been almost nothing has become powerful and important.

People who know me or have worked for me have often heard this saying: “Don’t give me the 10 reasons why something won’t work; Instead, find the one or two ways that it might work, and let’s go from there.” This statement sets a simple yet very important expectation.

Most people spend a lot of time and effort finding ways to prove that things will or should fail. I find that very frustrating. But, get the right people with the right mindset, and you can do some pretty amazing things. And, like Post It® notes, you might create something really cool that was completely unexpected. But you will never know if you don’t even get started.

So, actively look for examples of products or services that broke the rules. Try to understand the genesis of those ideas. And, the next time you think that something is impossible, remember PSO J318.5-22

Spurious Correlations – What they are and Why they Matter

In an earlier post, I mentioned that one of the big benefits of geospatial technology is its ability to show connections between complex and often disparate data sets. As you work with Big Data, you tend to see the value of these multi-layered and often multi-dimensional perspectives of a trend or event. While that can lead to incredible results, it can also lead to spurious data correlations.

First, let me state that I am not a Data Scientist or Statistician, and there are definitely people far more expert on this topic than myself. But, if you are like the majority of companies out there experimenting with geospatial and big data, it is likely that your company doesn’t have these experts on staff. So, a little awareness, understanding, and caution can go a long way in this scenario.

Before we dig into that more, let’s think about what your goal is:

- Do you want to be able to identify and understand a particular trend – reinforcing actions and/or behavior? –OR–

- Do you want to understand what triggers a specific event – initiating a specific behavior?

Both are important, but they are both different. My focus has been identifying trends so that you can leverage or exploit them for commercial gain. While that may sound a bit ominous, it is really what business is all about.

A popular saying goes, “Correlation does not imply causation.” A common example is that you may see many fire trucks for a large fire. There is a correlation, but it does not imply that fire trucks cause fires. Now, extending this analogy, let’s assume that the probability of a fire starting in a multi-tenant building in a major city is relatively high. Since it is a big city, it is likely that most of those apartments or condos have WiFi hotspots. A spurious correlation would be to imply that WiFi hotspots cause fires.

As you can see, there is definitely the potential to misunderstand the results of correlated data. A more logical analysis would lead you to see the relationships between the type of building (multi-tenant residential housing) and technology (WiFi) or income (middle-class or higher). Taking the next step to understand the findings, rather than accepting them at face value, is very important.

Once you have what looks to be an interesting correlation, there are many fun and interesting things you can do to validate, refine, or refute your hypothesis. It is likely that even without high-caliber data experts and specialists, you will be able to identify correlations and trends that can provide you and your company with a competitive advantage. Don’t let the potential complexity become an excuse for not getting started. As you can see, gaining insight and creating value with a little effort and simple analysis is possible.

Acting like an Owner – Does it matter?

One of the biggest changes to my professional perspective on business came when I started my own consulting business. Prior to that, I had worked as an employee for midsize to large companies for ten years and then as one of the first hires at a start-up technology company. I felt that doing hands-on work, managing, selling, and helping establish a start-up (where I did not have an equity stake) provided everything needed to start my own business.

Well, guess what? I was only partially correct. I was prepared for the activities of running the business but really was not prepared for the responsibility of running a business. While this seems like it should be obvious, I’ve seen many business owners whose primary focus is on growth/upside activities and not the day-to-day. That type of optimism is important for entrepreneurs – without it, they would not bother putting so much at risk.

People tend to adopt a different perspective when making decisions once they realize that every action and decision can impact the money moving into and out of their own wallets.

Even in a large business, you can usually spot the people who have taken these risks and run their own business. I was responsible for a Global Business Unit with $60+ million in annual sales and ran it like a “business within a business.” Having P&L responsibilities meant the decisions I made mattered to my success and the success of my business unit.

It’s more than just striking out on your own as a contractor or sole proprietor. I’m talking about the people who have had employees, invested in capital equipment and went all-in. These are the people thinking about the big picture and the future.

What do these people do differently than those without this type of experience?

One of the biggest things is they view business as “good business” and “bad business.” Not all business is good business, and not all customers are good customers. There needs to be a fair commercial exchange where both sides receive value, mutual respect, and open communication. You know this works when your customers treat you like a true partner (a real trusted advisor) instead of just a vendor, or at least do not try to take advantage of you (and vice-versa).

A business is in business to make money, so if your work is not profitable, you should not do it. And, if you are not delivering value to an organization, it is very likely that you would be better off spending your time elsewhere – building your reputation and reference base within an organization that was a better fit. While that may not be true for all business endeavors (think how long it took Amazon to become profitable and where they are now), it generally is true for employees at all levels.

“Bad” salespeople (who may very well regularly exceed their quotas) only care about the sale and their commission – not the fit, the customer’s satisfaction, or the effort required to support that customer. Selling products and services people don’t need, charging too little or too much, and making promises they know will not be met are typical signs of a person who does not think like an owner. Their focus is on the short-term and not on growing accounts. As an aside, their compensation plans generally only reward net new business and first-time sales, not ongoing customer satisfaction, so these actions may not be completely their fault.

How you view and treat employees is another big difference. Unfortunately, even business owners do not always get this right. I believe that employees are either viewed as Assets (to be managed for growth and long-term value) or Commodities (to be used up and replaced as needed – usually treated as fungible, as if they are easily replaceable). Your business is usually only as good as your employees, so treating them well and with respect creates loyalty and results in higher customer satisfaction.

Successful business owners usually look for the best person out there, not just the most affordable person who is “good enough” to do the job. On the flip side, you quickly need to weed out the people who are not a good fit. Making good decisions quickly and decisively is often a hallmark of a successful business owner. The saying about hiring slowly and firing quickly makes even more sense when you are running a lean operation that requires every person to contribute to the success of the company.

Successful business owners are generally more innovative. They are willing to experiment and take risks. They reward that behavior. They understand the need to find a niche where they can win and provide goods and/or services tailored to those specific needs.

Sometimes, this means specialization and customization, and sometimes, it means personalized attention and better support. Regardless of what is different, these people observe the small details, understand their target market, and are good at defining a message articulating those differences. These are the people who seem to be able to see around corners and anticipate both problems and opportunities. They do this out of necessity.

Former business owners are usually more conscientious about money, taking a “my money” perspective on sales and expenses. Every dollar in the business provides safety and opportunity for growth. These usually are not the people who routinely spend hundreds or thousands of dollars on business meals or who take unnecessary or questionable trips to nice places. Money saved on unnecessary expenses can be invested in new products, features, or marketing for the benefit of an organization.

While these are common traits of successful business owners, you can develop them even if you have never owned a business.

When selling, are you focused on delivering value, developing a positive reputation within that organization and with your customers, and profiting from long-term relationships? When delivering services, is your focus on delivering what has been contracted – and doing so on time and within budget? Are your projects used as examples of how things should be done within other organizations? Are you spending money on the right things – not wasteful or extravagant things?

These are things employees at all levels can do. They will make a difference and help you stand out. That opens the door to career growth and change. And it may get you thinking about starting the business you have always dreamed of. Awareness and understanding are the first steps towards change and improvement.