Technology

Genetics, Genomics, Nanotechnology, and more

Science has been interesting to me for most of my lifetime, but it wasn’t until my first child was born that I shifted from “interested” to “involved.” My eldest daughter was diagnosed with Systemic Onset Juvenile Idiopathic Arthritis (SoJIA – originally called Juvenile Rheumatoid Arthritis, or JRA) when she was 15 months old, which also happened to be about six months into the start of my old Consulting company and in the middle of a very critical Y2K ERP system upgrade and rehosting project. It was definitely a challenging time in my life.

At that time, there was very little research on JRA because it was estimated there were only 30,000 children affected by the disease, and the implication was that funding research would not have a positive ROI. This was also a few years before the breakthroughs of biological medicines like Enbrel for children.

One of the things that I learned was that this disease could be horribly debilitating. Children often had physical deformities as a result of this disease. Even worse, the systemic type that my daughter has could result in premature death. As a first-time parent, imagining that type of life for your child was extremely difficult.

Luckily, the company I had just started was taking off, so I decided to find ways to make a tangible difference for all children with this disease. We decided to take 50% of our net profits and use them to fund medical research. We aimed to fund $1 million in research and find a cure for Juvenile Arthritis within the next 5-7 years.

As someone new to “major gifts” and philanthropy, I quickly learned that some gifting vehicles were more beneficial than others. While most organizations wanted you to start a fund (which we did), the impact from that tended to be more long-term and less immediate. I met someone passionate, knowledgeable, and successful in her field who showed me a different and better approach (here’s a post that describes that in more detail).

I no longer wanted to blindly give money and hope it was used quickly and properly. Rather, I wanted to treat these donations like investments in a near-term cure. In order to be successful, I needed to understand research from both medical and scientific perspectives in these areas. That began a new research and independent learning journey in completely new areas.

There was a lot going on in Genetics and Genomics at the time (here’s a good explanation of the difference between the two). My interest and efforts in this area led to a position on the Medical and Scientific Advisory Committee with the Arthritis Foundation. With the exception of me, the other members were talented and successful physicians who were also involved with medical research. We met quarterly, and I did ask questions and made suggestions that made a difference. But, unlike everyone else on the committee, I needed to study and prepare for 40+ hours for each call to ensure that I had enough understanding to add value and not be a distraction.

A few years later we did work for a Nanotechnology company (more info here for those interested). The Chief Scientist wasn’t interested in explaining what they did until I described some of our research projects on gene expression. He then went into great detail about what they were doing and how he believed it would change what we do in the future. I saw that and agreed. I also started thinking of the potential for leveraging nanotechnology with medicine.

While driving today, I was listening to the “TED Radio Hour” and heard a segment about entrepreneur Richard Resnick. It was exciting because it got me thinking about this again – a topic I haven’t thought about for the past few years (the last time, I was contemplating how new analytics products could be useful in this space).

There are efforts today with custom, personalized medicines that target only specific genes for a specific outcome. The genetic modifications being performed on plants today will likely be performed on humans in the near future (I would guess within 10-15 years). The body is an incredibly adaptive organism, so it will be very challenging to implement anything that is consistently safe and effective long-term. But that day will come.

It’s not a huge leap from genetically modified “treatment cells” to true nanotechnology (not just extremely small particles). Just think, machines that can be designed to work independently within us to do what they are programmed to do and, more importantly, identify and understand adaptations (i.e., artificial intelligence) as they occur and alter their approach and treatment plan accordingly based on changes and findings. This is extremely exciting. It’s not that I want to live to be 100+ years old – because I don’t. But, being able to do things that positively impact the quality of life for children and their families is a worthy goal from my perspective.

My advice is to always continue learning, keep an open mind, and see what you can personally do to make a difference. You will never know unless you try.

Note: Updated to fix and remove dead links.

Are you Visionary or Insightful?

Having great ideas that are not understood or validated is pointless, just as being great at “filling in the gaps” to do amazing things does not accomplish much if what you are building achieves little toward your needs and goals. This post is about Dreaming Big and turning those dreams into actionable plans.

Let me preface this post by stating that both are important and complementary roles. But, if you don’t recognize the difference between the two, it becomes much more challenging to execute and realize value/gain a competitive advantage.

The Visionary has great ideas but doesn’t always create plans or follow through on developing the idea. There are many reasons why this happens (distractions, new interests, frustration, lack of time), so it is good to be aware of that, as this type of person can benefit by being paired with people willing and able to understand a new idea or approach, and then take the next steps to flesh out a high-level plan to present that idea and potential benefits to key stakeholders. People may view them as aloof or unfocused.

The Insightful sees the potential in an idea, helps others understand the benefits and gain their support, and often creates and executes a plan to prototype and validate the idea – killing it off early if the anticipated goals are unachievable. They document, learn from these experiences, and become more and more proficient with validating the idea or approach and quantifying the potential benefits. They are usually very pragmatic.

Neither of these types of people is affected by loss aversion bias.

I find it amazing how frequently you hear someone referred to as being Visionary, only to see that the person in question could eliminate some of the noise and “see further down the road” than most people. While this skill is valuable, it is more akin to analytics and science than art. Insight usually comes from focus, understanding, intelligence, and being open-minded. Those qualities matter in both business and personal settings.

On the other hand, someone truly visionary looks beyond what is already illuminated and can, therefore, be detected or analyzed. It’s like a game of chess where the visionary person is thinking six or seven moves ahead. They are connecting the dots for the various future possibilities while their competitor is still thinking about their next move.

Interestingly, this can be a very frustrating situation for everyone.

- The Visionary with an excellent idea may become frustrated because they feel an unmet need to be understood.

- The people around that visionary person become frustrated, wondering why that person isn’t able to focus on what is important or why they fail to see/understand the big picture.

- Others view the visionary ideas and suggestions as tangential or irrelevant. It is only over time that the others understand what the visionary person was trying to show them – often after a competitor has started executing a similar idea.

- The Insightful wanting to make a difference can feel constrained in static environments, offering little opportunity for change and improvement.

Both Insightful and Visionary people feel that they are being strategic. Both believe they are doing the right thing. Both have similar goals. What’s truly ironic is they may view each other as the competition rather than seeing the potential of collaborating.

A strong management team can positively impact creativity by fostering a culture of innovation and placing these people together to work towards a common goal. Providing little time and resources to explore an idea can lead to remarkable outcomes. When I had my consulting company, I sometimes joked, “What would Google do?” to describe that amazing things were possible and waiting to be done.

The insightful person may see a payback on their ideas sooner than the visionary person, and that is due to their focus on what is already in front of them. It may be a year or more before what the visionary person has described shifts to the mainstream and into the realm of insight – hopefully before it reaches the realm of common sense (or worse yet, is entirely passed by).

I recommend that people create a system to gather ideas, along with a description of what the purpose, goals, and advantages of those ideas are. Foster creative behavior by rewarding people for participation regardless of what becomes of the idea. Review those ideas regularly and document your commentary. You will find good ideas with luck – some insightful and possibly even visionary.

Look for commonalities and trends to identify the people who can cut through the noise or see beyond the periphery and the areas having the greatest innovation potential. This approach will help drive your business to the next level.

You never know where the next good idea will come from. Efforts like these provide growth opportunities for people, products, and profits.

Profitability through Operational Efficiency

In my last post, I discussed the importance of proper pricing for profitability and success. As most people know, you increase profitability by increasing revenue and/or decreasing costs. However, cost reduction does not necessarily mean slashing headcount, wages, benefits, or other factors that often negatively affect morale and cascade negatively on quality and customer satisfaction. There is often a better way.

The best businesses generally focus on repeatability and reliability, realizing that the more you do something – the better you should get at doing it well. You develop a compelling selling story based on past successes, develop a solid reference base, and have identified the sweet spot from a pricing perspective. People keep buying what you are selling, and if your pricing is right, money is available at the end of the month to fund organic growth and operational efficiency efforts.

Finding ways to increase operational efficiency is the ideal way to reduce costs, but it takes time and effort. Sometimes this is realized through increases in experience and skill. But, often optimization occurs through standardization and automation. Developing a system that works well, consistently applying it, measuring and analyzing the results, and then making changes to improve the process. An added benefit is that this approach increases quality, making your offering even more attractive.

Metrics should be collected at a “work package” level or lower (e.g., task level), which means they are related tasks at the lowest level that produce a discrete deliverable. This project management concept works whether you are manufacturing something (although a Bill of Materials may be a better analogy in this segment), building something, or creating something. This allows you to accurately create and validate cost and time estimates. When analyzing work at this level of detail, it becomes easier to identify ways to simplify or automate the process.

When I had my company, we leveraged this approach to win more business with competitive fixed-price project bids that provided healthy profit margins for us while minimizing risk for our clients. Bigger profit margins allowed us to invest in our own growth and success by funding ongoing employee training and education, innovation efforts, and international expansion, as well as experimenting with new things (products, technology, methodology, etc.) that were fun and often taught us something valuable.

Those growth activities were only possible because we focused on doing everything as efficiently and effectively as possible, learning from everything we did – good and bad, and having a tangible way to measure and prove that we were constantly improving.

Think like a CEO, act like a COO, and measure like a CFO. Do this and make a real difference in your own business!

The Importance of Proper Pricing

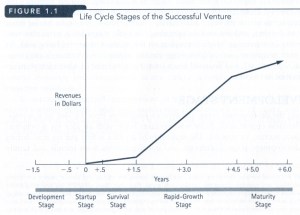

Pricing is one of those things that can make or break a company. Doing it right takes an understanding of your business (cost structure and growth / profitability goals), the market, your competition, and more. Doing it wrong can mean the death of your business (fast or slow), the inability to attract and retain the best talent, as well as creating a situation where you will no longer have the opportunity to reach your full potential.

These problems apply to companies of all sizes – although large organizations are often better positioned to absorb the impact of bad pricing decisions or sustain an unprofitable business unit. Understanding all possible outcomes is an important aspect of pricing related to risk and risk tolerance.

When I started my consulting company in 1999, we planned to win business by pricing our services 10%-15% lower than the competition. It was a bad plan that didn’t work. Unfortunately, this approach is something you see all too often in businesses today.

We only began to grow after increasing our prices (about 10% more than the competition) and focused on justifying that with our expertise and the value provided. We were (correctly) perceived as a premium alternative, and that positioning helped us grow.

Several years ago, I had a management consulting engagement with a small software company. The business owner told me they were “an overnight success 10 years in the making.” His concern was that they might not be able to capitalize on recent successes, so he was looking for an outside opinion.

I analyzed his business, product, customers, and competition. His largest competitor is the industry leader in this space, and products from both companies were evenly matched from a feature perspective. My client’s product even had a few key features that were better for management and compliance in Healthcare and Union environments that his larger and more popular competitor lacked. So, why weren’t they growing faster?

I found that competition was priced 400% higher for the base product. When I asked the owner, he told me their goal was to be priced 75% – 80% less than the competition. He could not explain why he did this other than to state that he believed that his customers would be unwilling to pay any more than that. His lack of confidence in his product became evident to companies interested in his solution.

He often lost head-to-head competition against that competitor, but almost never on features. Areas of concern were generally the size and profitability of the company and the risk created by each for prospects considering his product.

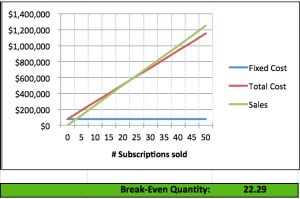

I shared the graph (below) with this person, explaining how proper pricing would increase their profitability and annual revenue and how both of those items would help provide customers and prospects with confidence. Moreover, this would allow the company to grow, eliminate single points of failure in key areas (Engineering and Customer Support), add features, and even spend money on marketing. Success breeds success!

In another example, I worked with the Product Manager of a large software company responsible for producing quarterly product package distributions. This work was outsourced, and each build cost approximately $50K. I asked, “What is the break-even point for each distribution?” That person replied, “There really isn’t a good way to tell.”

By the end of the day, I provided a Cost-Volume-Profit (CVP) analysis spreadsheet that showed the break-even point. Even more important, it showed the contribution margin and demonstrated there was very little operating leverage provided these products (i.e., they weren’t very profitable even if you sold many of them).

My recommendations included increasing prices (which could negatively impact sales), investing in fewer releases per year, or finding a more cost-effective way of releasing those products. Without this analysis their “business as usual” approach would have likely continued for several years.

Companies are in business to make money – pure and simple. Everything you do as a business owner or leader needs to be focused on growth. Growth is the result of a combination of factors, such as the uniqueness of the product or services provided, quality, reputation, efficiency, and repeatability. Many of these are the same factors that also drive profitability. Proper pricing can help predictably drive profitability, and having excess profits to invest can significantly impact growth.

Some customers and prospects will do everything possible to whittle your profit margins down to nothing. They are focused on their own short-term gain and not on the long-term risk created for their suppliers. Those same “frugal” companies expect to profit from their own business, so it is unreasonable to expect anything less from their suppliers.

My feeling is that “Not all business is good business,” so it is better to walk away from bad business in order to focus on the business that helps your company grow and be successful.

One of the best books on pricing I’ve ever found is “The Strategy and Tactics of Pricing: A Guide to Profitable Decision Making” by Thomas T. Nagle and Reed K. Holden. I recommend this extremely comprehensive and practical book to anyone responsible for pricing or with P&L responsibility within an organization. It addresses the many complexities of pricing and is truly an invaluable reference.

In a future post, I will write about the metrics I use to understand efficiency and profitability. Metrics can be your best friend when optimizing pricing and maximizing profitability. This can help you create a systematic approach to business that increases efficiency, consistency, and quality.

At my company we developed a system where we know how long common tasks would take to complete, and had efficiency factors for each consultant. This allowed us to create estimates based on the type of work and the people most likely to work on the task and fix-bid the work. Our bids were competitive, and even when we were the highest-priced bid we often won because we would be the only (or one of the few) companies to guarantee prices and results. Our level of effort estimates were +/- 4%, and that helped us maintain a 40%+ minimum gross margin for every project. This analytical approach helped our business double in revenue without doubling in size.

There are many causes of poor pricing, including a lack of understanding of cost structure; Lack of understanding of the value provided by a product or service; Lack of understanding of the level of effort to create, maintain, deliver, and improve a product or service; and Lack of concern for profitability (e.g., salespeople who are paid on the size of the deal, and not on margins or profitability).

But, with a little understanding and effort, you can make small adjustments to your pricing approach and models that can have a huge impact on your business’s bottom line.

A missed opportunity for Geospatial

I have a Corvette that I like to work on for fun and relaxation. It gives me an excuse to learn something new and an opportunity to hone my troubleshooting skills. It can be a fun way to spend a few hours on a weekend.

A few weekends ago I was looking for a few parts for a small project. This was spur of the moment and really didn’t need to be done now (as the car will be stored soon for the winter). I found the parts I needed from a single company, but then something strange happened.

This website had my address, knew the two parts that I wanted, but failed to make the process easy and almost lost a sale. I needed to manually check five different store locations to see if they had both parts. In this case two of the five did. One store was about 5 miles from my house and the other about 20 miles away.

Just think how helpful it would have been for this website to use the data available (i.e., inventory and locations) and present me with the two options or better yet default me to the closest store and note the other store as an option. Using spatial features this would be extremely easy to implement. It’s the equivalent to the “Easy Button” that one office supply uses in their commercials.

Now, take this example one step further. The website makes things quick and easy, leaving me with a very pleasant shopping experience. It could then recommend related items (it did, but by that time I had wasted more time than necessary and was questioning whether or not I should start that project that day). The website could have also created a simple package offer to try to increase my shopping cart value.

All simple things that would generate more money through increased sales and larger sales. It would seem that this would be very easy to justify from both a business and technical perspective, assuming the company is even aware of this issue.

I frequently tell my team that, “People buy easy.” Help them understand what they need to accomplish their goals, price it fairly, demonstrate the value, and they make the rest of the sales process easy to complete. This makes happy customers and leads to referrals. It just makes good business sense to do this.

So, while geospatial technology might not be the solution to all problems, this is a specific use case where it would. The power of computing systems and applications today is that there is so much that can be done so fast, often for reasonably low investment costs in technology. But the first step getting there is to ask yourself, “How could we be making this process easier for our customers?”

A little extra effort and insight can have a huge payoff.